When people talk about a company’s success, they often throw around numbers like revenue, sales, or *growth rate. But the truth is, none of those tell the full story. What really shows how healthy a business is? Profit margin. Let’s break down how it’s calculated, why it matters, and what it reveals about a company’s performance.

What Is Profit Margin in Business Terms?

Profit margin is the percentage of revenue that remains as profit after all expenses are deducted. It tells you how efficiently a company turns sales into real profit.

There are a few types of profit margins gross margin, operating margin, and net profit margin and each highlights a different part of your company’s financial performance.

Simply put:

> Profit Margin = (Net Profit ÷ Revenue) × 100

This formula works whether you’re analyzing a small business, an eCommerce brand, or a multinational company.

How to Calculate Profit Margin Step by Step

Let’s keep it simple:

1. Find your total revenue – all the money your business earned.

2. Subtract your total expenses – this includes cost of goods sold (COGS), marketing costs, salaries, and taxes.

3. Divide your net profit by total revenue.

4. Multiply by 100 to get the percentage.

Example:

If your company made £200,000 in sales and had £150,000 in total costs, your net profit is £50,000.

So, Profit Margin = (50,000 ÷ 200,000) × 100 = 25%.

That means you keep 25p of every pound you earn.

Gross, Operating, and Net Profit Margins Explained

Here’s the thing not all profit margins mean the same thing.

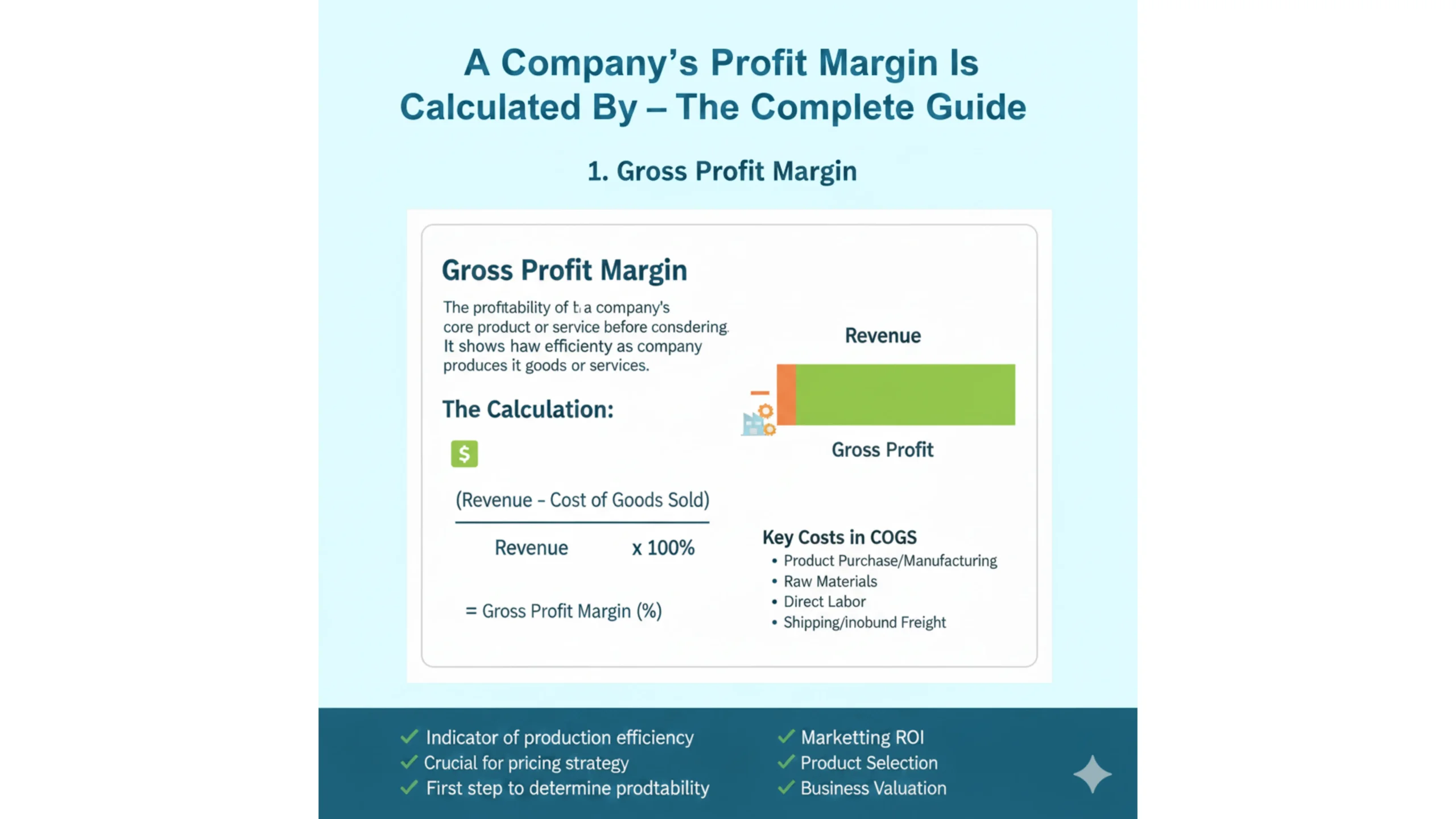

* Gross Profit Margin: Focuses on revenue minus the direct cost of goods sold. It shows production efficiency.

* Operating Profit Margin: Includes operating expenses like rent and payroll — it measures how efficiently you run daily operations.

* Net Profit Margin: The final number after *all* expenses, interest, and taxes. It shows the company’s true profitability.

Understanding all three gives you a full financial picture not just surface-level numbers.

Why Profit Margin Matters for Every Business

Profit margin isn’t just a finance metric; it’s a business health indicator.

It shows:

* Whether your pricing strategy makes sense.

* If your expenses are under control.

* How much room you have for growth or reinvestment.

Investors, lenders, and even potential buyers use profit margins to judge a company’s financial stability and long-term potential.

How to Improve Your Company’s Profit Margin

If your profit margin looks tight, don’t panic it’s fixable. Try this:

* Reduce operating costs without cutting quality.

* Increase prices slightly if your product provides strong value.

* Streamline supply chains and negotiate better deals with vendors.

* Automate repetitive tasks to cut down on labor costs.

* Focus on high-margin products or services that bring in more profit per sale.

The goal is to create a sustainable balance higher efficiency, steady revenue, and consistent profit growth.

Final Thoughts

A company’s profit margin is calculated by comparing net profit to total revenue but what it really reveals is how smartly a business operates. Whether you’re a startup or an established brand, knowing your margin (and how to improve it) gives you control over your financial future.