Problem 1: Coffee Shop Owner (Beginner)

Scenario: Sarah owns a coffee shop. Last month, her total sales were $8,000. She spent $3,200 on coffee beans, milk, cups, and other supplies directly used to make her products.

Question: What is Sarah’s Gross Profit Percentage?

Solution:

Step 1 – Identify Revenue: Revenue = $8,000

Step 2 – Identify COGS: COGS = $3,200 (coffee beans + milk + cups + supplies)

Step 3 – Calculate Gross Profit: Gross Profit = Revenue − COGS Gross Profit = $8,000 − $3,200 = $4,800

Step 4 – Calculate GP%: GP% = (Gross Profit ÷ Revenue) × 100 GP% = ($4,800 ÷ $8,000) × 100 = 60%

Interpretation: Sarah keeps $0.60 for every $1 of sales before paying rent, staff wages, and utilities. A 60% GP% is excellent for a coffee shop (industry average is 25–35%). Sarah has strong pricing or efficient sourcing.

Problem 2: Online Clothing Store (Beginner)

Scenario: Jake runs an online clothing store. His quarterly figures are:

- Total Revenue: $45,000

- Cost of Goods (wholesale clothing): $27,000

- Shipping to customers: $3,500

- Website hosting fees: $500

Question: What is Jake’s GP%? Which costs are included in COGS?

Solution:

Step 1 – Identify COGS correctly: Only direct product costs count as COGS.

- Wholesale clothing: $27,000 ✅ (direct cost of goods)

- Shipping to customers: $3,500 ✅ (direct fulfillment cost)

- Website hosting: $500 ❌ (operating expense, NOT COGS)

Total COGS = $27,000 + $3,500 = $30,500

Step 2 – Calculate Gross Profit: Gross Profit = $45,000 − $30,500 = $14,500

Step 3 – Calculate GP%: GP% = ($14,500 ÷ $45,000) × 100 = 32.2%

Interpretation: Jake’s 32.2% GP% is within the normal ecommerce range (30–50%). His website fees are operating expenses and will come out of the gross profit later when calculating net profit.

Key Lesson: Always separate COGS (direct product costs) from operating expenses (overhead costs). Mixing them gives a misleading GP%.

Problem 3: Manufacturing Company — Comparing Two Products (Intermediate)

Scenario: A furniture manufacturer produces two product lines:

| Wooden Chairs | Metal Shelves | |

|---|---|---|

| Revenue | $80,000 | $60,000 |

| Raw Materials | $25,000 | $22,000 |

| Direct Labor | $15,000 | $18,000 |

| Factory Overhead | $8,000 | $5,000 |

Question: Which product line has a better GP%? Which should the company prioritize?

Solution:

Wooden Chairs: COGS = $25,000 + $15,000 + $8,000 = $48,000 Gross Profit = $80,000 − $48,000 = $32,000 GP% = ($32,000 ÷ $80,000) × 100 = 40%

Metal Shelves: COGS = $22,000 + $18,000 + $5,000 = $45,000 Gross Profit = $60,000 − $45,000 = $15,000 GP% = ($15,000 ÷ $60,000) × 100 = 25%

Interpretation: Although Metal Shelves have lower raw material costs, the higher labor costs drag down the GP%. Wooden Chairs generate 40% GP% vs 25% for Metal Shelves.

The company should prioritize Wooden Chairs production for better profitability, or find ways to reduce labor costs in the Metal Shelves line.

Key Lesson: Higher revenue doesn’t always mean higher GP%. Analyze each product individually to find your most profitable lines.

Problem 4: Declining GP% — Finding the Problem (Intermediate)

Scenario: A grocery store’s GP% dropped from 35% last year to 28% this year. The owner wants to find out why.

| Last Year | This Year | |

|---|---|---|

| Revenue | $500,000 | $520,000 |

| COGS | $325,000 | $374,400 |

| Gross Profit | $175,000 | $145,600 |

| GP% | 35% | 28% |

Question: What caused the GP% to drop? Revenue actually grew — so why is profit down?

Solution:

Step 1 – Verify the GP% calculations: Last Year: ($175,000 ÷ $500,000) × 100 = 35% ✅ This Year: ($145,600 ÷ $520,000) × 100 = 28% ✅

Step 2 – Find the COGS growth rate: COGS increase = ($374,400 − $325,000) ÷ $325,000 × 100 = 15.2% increase

Step 3 – Find the Revenue growth rate: Revenue increase = ($520,000 − $500,000) ÷ $500,000 × 100 = 4% increase

Analysis:

- Revenue grew by 4%

- COGS grew by 15.2%

COGS grew nearly 4× faster than revenue. This means supplier prices rose sharply, or the store started selling more low-margin products, or both.

Possible causes:

- Supplier price increases not passed on to customers

- Increased shrinkage/waste

- Shift toward discounted or low-margin product mix

- Seasonal buying errors

Recommended Fix: Renegotiate supplier contracts, review pricing strategy, and audit inventory waste.

Key Lesson: Always compare GP% trend over time — not just absolute profit. Growing revenue with a shrinking GP% is a warning sign.

Problem 5: Pricing Decision Using GP% (Intermediate)

Scenario: A freelance graphic designer sells logo design packages. She wants to price a new service package correctly to achieve a minimum 65% GP%.

Her estimated costs to deliver one package:

- Stock asset licenses: $40

- Software subscription (allocated per project): $25

- Contractor help (occasional): $60

Question: What is the minimum price she must charge?

Solution:

Step 1 – Calculate Total COGS per project: COGS = $40 + $25 + $60 = $125

Step 2 – Use the GP% formula in reverse:

GP% = (Gross Profit ÷ Revenue) × 100

She wants GP% = 65%, so: 0.65 = (Revenue − $125) ÷ Revenue

Rearranging: 0.65 × Revenue = Revenue − $125 $125 = Revenue − 0.65 × Revenue $125 = Revenue × (1 − 0.65) $125 = Revenue × 0.35 Revenue = $125 ÷ 0.35 = $357.14

Answer: She must charge at least $358 per package to achieve a 65% GP%.

Verification: Gross Profit = $358 − $125 = $233 GP% = ($233 ÷ $358) × 100 = 65.1% ✅

Key Lesson: You can work the GP% formula backwards to set minimum prices — a powerful tool for freelancers and service businesses.

Problem 6: Multi-Month GP% Comparison (Advanced)

Scenario: A SaaS startup tracks its GP% monthly. Here are 6 months of data:

| Month | Revenue | COGS | Gross Profit | GP% |

|---|---|---|---|---|

| January | $30,000 | $9,000 | $21,000 | 70% |

| February | $32,000 | $10,880 | $21,120 | 66% |

| March | $35,000 | $13,300 | $21,700 | 62% |

| April | $38,000 | $15,960 | $22,040 | 58% |

| May | $40,000 | $18,000 | $22,000 | 55% |

| June | $42,000 | $20,160 | $21,840 | 52% |

Question: Despite growing revenue every month, is this business actually improving? What does the GP% trend reveal?

Solution:

Calculating each month’s GP%:

- January: ($21,000 ÷ $30,000) × 100 = 70%

- February: ($21,120 ÷ $32,000) × 100 = 66%

- March: ($21,700 ÷ $35,000) × 100 = 62%

- April: ($22,040 ÷ $38,000) × 100 = 58%

- May: ($22,000 ÷ $40,000) × 100 = 55%

- June: ($21,840 ÷ $42,000) × 100 = 52%

Analysis:

- Revenue grew 40% over 6 months ✅

- Gross profit in dollars barely grew (from $21,000 to $21,840 = only 4% growth) ⚠️

- GP% dropped from 70% to 52% — an 18-point decline 🚨

What this means: This is a “growth trap.” The company is winning more customers but its costs are scaling faster than revenue. Every new customer is costing more to serve. If the trend continues unchecked, the company will eventually make zero gross profit despite having high revenue.

Possible causes for a SaaS company:

- Server/cloud costs scaling with user growth inefficiently

- Higher customer acquisition costs included in COGS incorrectly

- Increase in support staff as direct cost

Action Required: Audit the cost structure, optimize cloud infrastructure, and potentially raise prices or tier the service.

Key Lesson: Never celebrate revenue growth without checking your GP% trend. A declining GP% is an early warning signal — even when revenue looks healthy.

Problem 7: Retail Business — Impact of a Discount Sale (Advanced)

Scenario: A shoe retailer normally sells a pair of shoes for $120. The cost of each pair is $60.

During a clearance sale, they discount all shoes by 30%.

Question:

- What is the normal GP%?

- What is the GP% during the sale?

- How many extra pairs must they sell during the sale to match the same gross profit as selling 100 pairs at normal price?

Solution:

Part 1 — Normal GP%: Normal Price = $120 COGS = $60 Gross Profit per unit = $120 − $60 = $60 Normal GP% = ($60 ÷ $120) × 100 = 50%

Part 2 — Sale GP%: Sale Price = $120 × (1 − 0.30) = $120 × 0.70 = $84 COGS = $60 (unchanged) Gross Profit per unit during sale = $84 − $60 = $24 Sale GP% = ($24 ÷ $84) × 100 = 28.6%

The discount nearly halved the GP% — from 50% to 28.6%.

Part 3 — Break-even volume calculation: Normal: 100 pairs × $60 gross profit = $6,000 total gross profit Sale: Need $6,000 ÷ $24 gross profit per pair = 250 pairs

They must sell 150% more units during the sale just to match normal profitability.

Summary Table:

| Scenario | Price | GP per Unit | GP% | Units to Make $6,000 |

|---|---|---|---|---|

| Normal | $120 | $60 | 50% | 100 pairs |

| 30% Sale | $84 | $24 | 28.6% | 250 pairs |

Key Lesson: Discounts seem small but have a multiplied negative impact on GP%. A 30% price cut reduced the gross profit per unit by 60%. Always calculate the break-even volume before running a sale.

Problem 8: Comparing Two Business Models (Advanced)

Scenario: Two friends both start businesses with the same $200,000 revenue:

Business A – Wholesale Distributor

- Revenue: $200,000

- COGS: $160,000

Business B – Software Company

- Revenue: $200,000

- COGS: $30,000

Question: Calculate and compare both GP%s. Which business is more valuable and why?

Solution:

Business A (Wholesale): Gross Profit = $200,000 − $160,000 = $40,000 GP% = ($40,000 ÷ $200,000) × 100 = 20%

Business B (Software): Gross Profit = $200,000 − $30,000 = $170,000 GP% = ($170,000 ÷ $200,000) × 100 = 85%

Analysis:

| Business A | Business B | |

|---|---|---|

| Revenue | $200,000 | $200,000 |

| Gross Profit | $40,000 | $170,000 |

| GP% | 20% | 85% |

| Money left for expenses | $40,000 | $170,000 |

Business B has 4.25× more money left to cover rent, salaries, marketing, and still make a net profit — despite identical revenue.

Why this matters to investors: A software business with 85% GP% is typically valued at 5–15× revenue. A wholesale business with 20% GP% is typically valued at 0.5–2× revenue.

Same $200,000 revenue could mean a $1,000,000 vs $10,000,000+ valuation difference based on GP% alone.

Key Lesson: GP% is a core driver of business valuation. High-GP% business models (software, digital products, consulting) scale far more profitably than low-GP% models (wholesale, retail, manufacturing) at the same revenue level.

Quick Reference: Common GP% Mistakes & Fixes

| Mistake | Wrong Calculation | Correct Calculation |

|---|---|---|

| Including operating expenses in COGS | COGS = materials + rent + salaries | COGS = materials + direct labor only |

| Confusing GP% with markup | GP% = Profit ÷ Revenue | Markup = Profit ÷ Cost |

| Using gross profit $ instead of % | “We made $50,000 profit” | “We have a 40% GP%” |

| Ignoring GP% trend | Looking only at this month | Comparing month-over-month |

| Wrong revenue figure | Using projected/budgeted revenue | Using actual collected revenue |

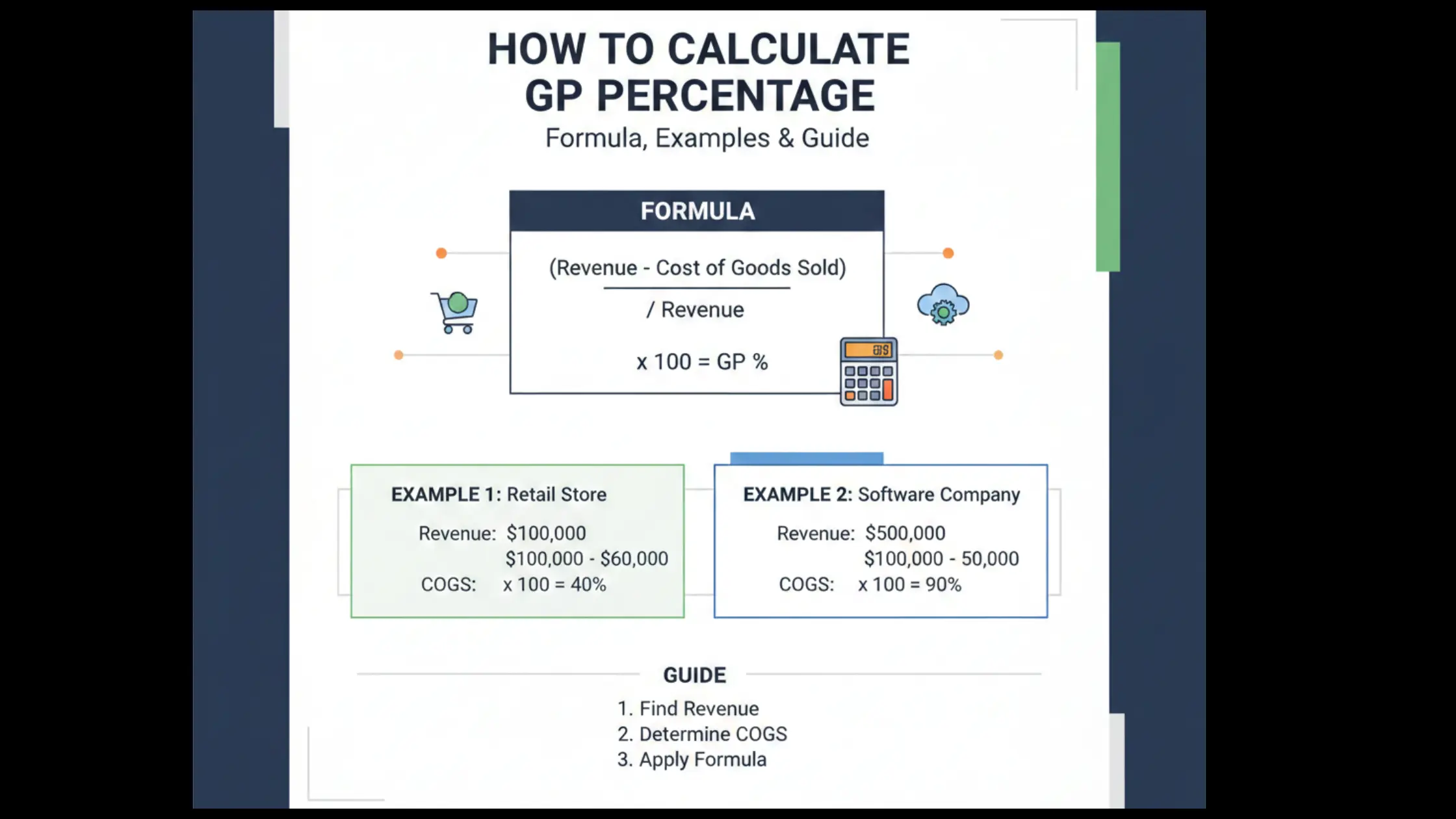

Formula Summary Card

| What You Want to Find | Formula |

|---|---|

| Gross Profit | Revenue − COGS |

| GP% | (Gross Profit ÷ Revenue) × 100 |

| Minimum Price for Target GP% | COGS ÷ (1 − Target GP% as decimal) |

| COGS from Revenue + GP% | Revenue × (1 − GP% as decimal) |

| Revenue from Profit + GP% | Gross Profit ÷ GP% as decimal |