Introduction

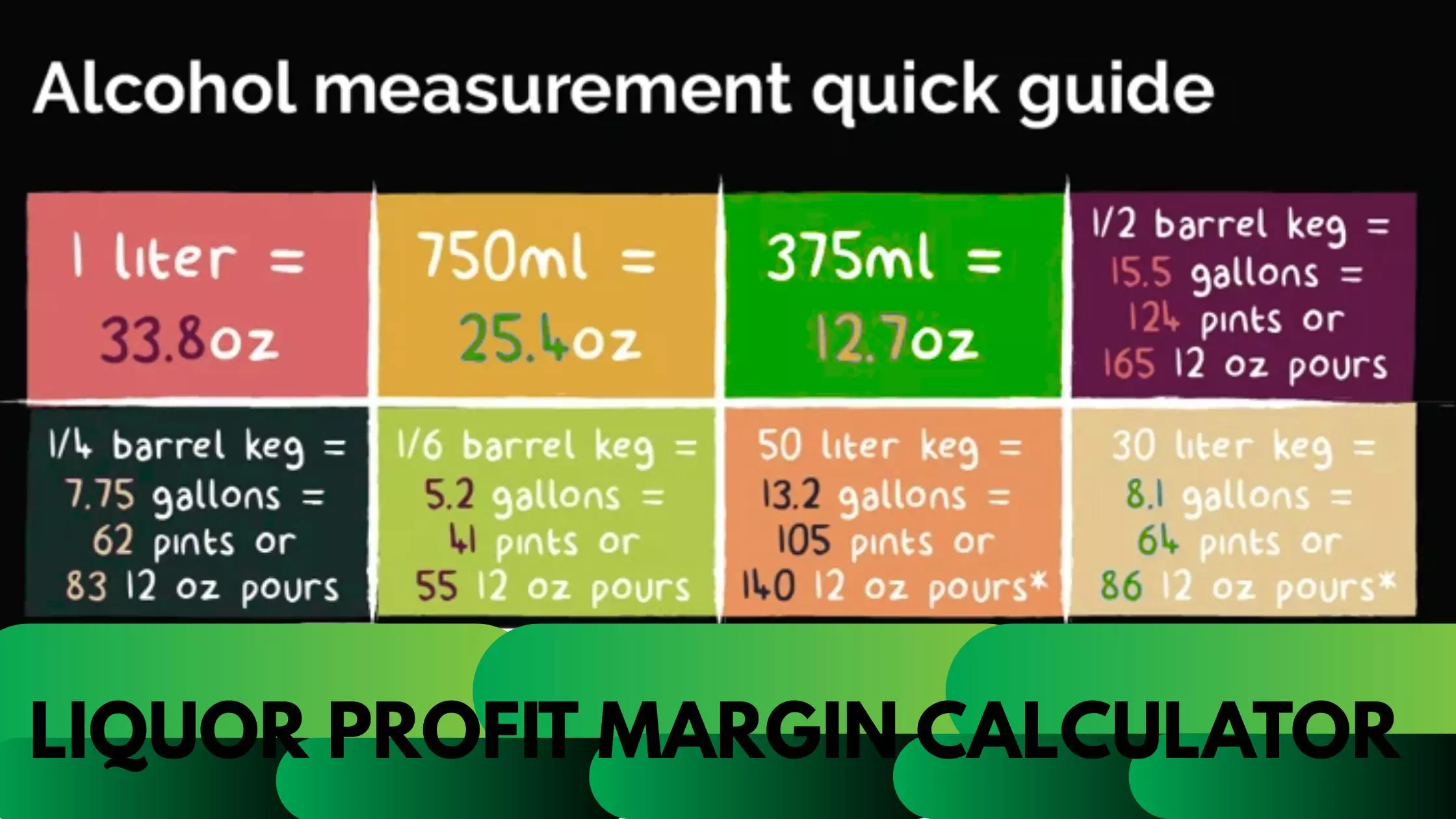

Running a liquor store, bar, or online alcohol business is rewarding but comes with financial challenges. Understanding exactly how much profit each product generates is critical to long-term success. That’s where a liquor profit margin calculator becomes essential. This tool helps business owners calculate profit margins accurately, accounting for costs, selling prices, taxes, and overheads.

Profit margins in the liquor industry are influenced by wholesale costs, licensing fees, seasonal demand, and promotional discounts. Without accurate calculations, even popular products can reduce your overall revenue. A liquor profit margin calculator not only simplifies this process but also enables strategic business decisions.

Whether you manage a small boutique liquor store or a busy bar, this tool ensures sustainability and competitiveness. It highlights high-margin products, supports pricing decisions, and helps maintain balance between revenue and customer satisfaction.

This guide will explain everything you need to know: how to use the calculator, key factors affecting liquor profit margins, tips for maximizing profits, a comparison table of products, and frequently asked questions. By the end, you’ll understand why integrating a liquor profit margin calculator into your operations is a smart move for growing your alcohol business.

What Is a Liquor Profit Margin Calculator?

A liquor profit margin calculator is a specialized tool designed to determine the profitability of alcoholic beverages. Unlike generic calculators, it accounts for liquor-specific costs like taxes, shipping, and licensing fees.

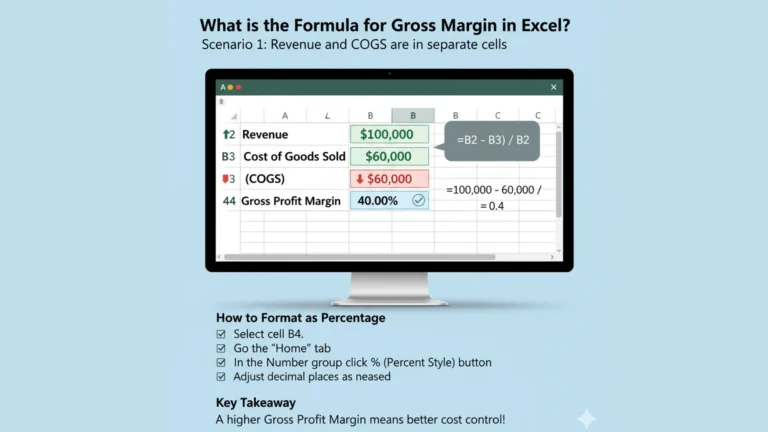

Using the calculator is simple. Enter the total cost of a product, including purchase price, taxes, shipping, and overheads, along with the intended selling price. The tool calculates the profit margin as a percentage, showing the actual profit generated per product.

For instance, if a bottle of whiskey costs $20 and sells for $35, the calculator shows your gross profit and percentage margin. This insight helps identify high-performing products and under performing ones needing pricing adjustments.

The key benefit is accuracy. Manual calculations can lead to errors, impacting profitability. A liquor profit margin calculator enables data-driven decisions, ensuring better pricing, inventory management, and overall financial planning.

Why Profit Margins Matter in the Liquor Business

Profit margins are the backbone of any liquor business. They provide clarity on how much revenue each product generates and inform strategic decisions about pricing, promotions, and inventory.

High-margin products allow reinvestment into the business, whether through marketing, store upgrades, or expanding product offerings. Low-margin items may require adjustments to avoid losses.

Seasonal demand is another factor. Alcohol sales often peak during holidays or special events. Knowing which products deliver the best margins ensures you stock efficiently and maximize profits during peak periods.

Monitoring profit margins also aids supplier negotiations. Understanding target margins helps make informed decisions about bulk purchases, discounts, and exclusive deals. In short, tracking profit margins ensures financial stability and sustainable business growth.

How to Use a Liquor Profit Margin Calculator Effectively

Start by listing all product costs, including purchase price, taxes, shipping, and overheads. Enter these values along with the desired selling price into the calculator.

Review the calculated profit margin to ensure it meets your target. Adjust the selling price if necessary to hit a healthy margin. A typical target margin for liquor businesses is 35–45%, depending on the product type and competition.

Use the calculator regularly, especially when costs or market conditions change. Seasonal fluctuations, supplier price changes, and competitor pricing all affect margins. Frequent recalculations ensure accuracy.

Avoid mistakes like ignoring taxes or underestimating overheads, as these reduce profitability. Combining the calculator with periodic financial audits ensures a sustainable business model.

Finally, leverage the insights. Promote high-margin products, adjust marketing strategies, and plan inventory to maximize profits.

Key Factors That Affect Liquor Profit Margins

Several factors influence liquor profit margins:

- Wholesale cost: Lower purchase prices generally improve profit margins.

- Taxes and licensing fees: Regional differences impact overall profitability.

- Discounts and promotions: Reduce revenue per unit but can boost volume.

- Operational costs: Staff wages, rent, and utilities affect net profit.

- Seasonal demand: Sales peaks during holidays or events can improve margins.

- Competitive pricing: Balance profitability with customer value.

Understanding these factors helps in planning pricing strategies, inventory management, and marketing campaigns.

Tips to Maximize Profits Using a Liquor Profit Margin Calculator

- Update product costs and selling prices regularly.

- Focus on high-margin products in marketing and promotions.

- Adjust seasonal pricing to optimize revenue.

- Monitor competitor pricing while maintaining target margins.

- Include all hidden costs like taxes, shipping, and storage.

Key Points

- Simplifies profit tracking and decision-making.

- Identifies high-performing and under performing products.

- Reduces errors from manual calculations.

- Supports strategic pricing, promotions, and inventory management.

- Essential for business sustainability and revenue optimization.

Table Format

| Liquor Type | Cost Price | Selling Price | Profit Margin | Notes |

|---|---|---|---|---|

| Whiskey | $20 | $35 | 42.8% | High-margin product |

| Vodka | $15 | $25 | 40% | Steady sales |

| Wine | $12 | $20 | 40% | Seasonal demand |

| Rum | $18 | $28 | 35.7% | Competitive pricing needed |

| Tequila | $25 | $40 | 37.5% | Premium pricing |

FAQs

How do I Calculate Liquor Profit Margin?

Subtract the cost from the selling price, divide by selling price, and multiply by 100.

What is a Good Profit Margin for Liquor?

Most liquor businesses aim for 35–45% depending on product and market.

Can I use this Calculator for online Liquor Sales?

Yes, it works for both in-store and online pricing, including all costs.

Should I include Taxes in the Margin Calculation?

Always include taxes for an accurate picture of real profits.

How often should I update the Calculator?

Update whenever costs, selling prices, or taxes change to maintain accuracy.

Bottom Line

A liquor profit margin calculator is vital for maximizing profits, tracking revenue, and making informed pricing decisions. Using this tool ensures sustainable growth and a competitive edge in the alcohol business. Start implementing it today to optimize your liquor sales.