Understanding your operating profit margin is key to knowing how efficiently your business turns sales into real profit. Whether you’re managing an eCommerce store or a local service company, this ratio helps you evaluate your business profitability metrics and overall operating efficiency.

Let’s break it down in a way that’s clear, practical, and actually useful.

What Is Operating Profit Margin?

Your operating profit margin measures how much profit remains from your revenue and expenses after subtracting all operating costs—like wages, materials, and rent—but before taxes and interest.

In simple terms, it’s your profit ratio analysis for operations.

Here’s what it tells you:

- A high operating margin means your company manages its costs well and runs efficiently.

- A low margin suggests that expenses are eating into your revenue and you may need to review costs or pricing.

This ratio shows how strong your operating income formula really is and whether your business model is financially healthy.

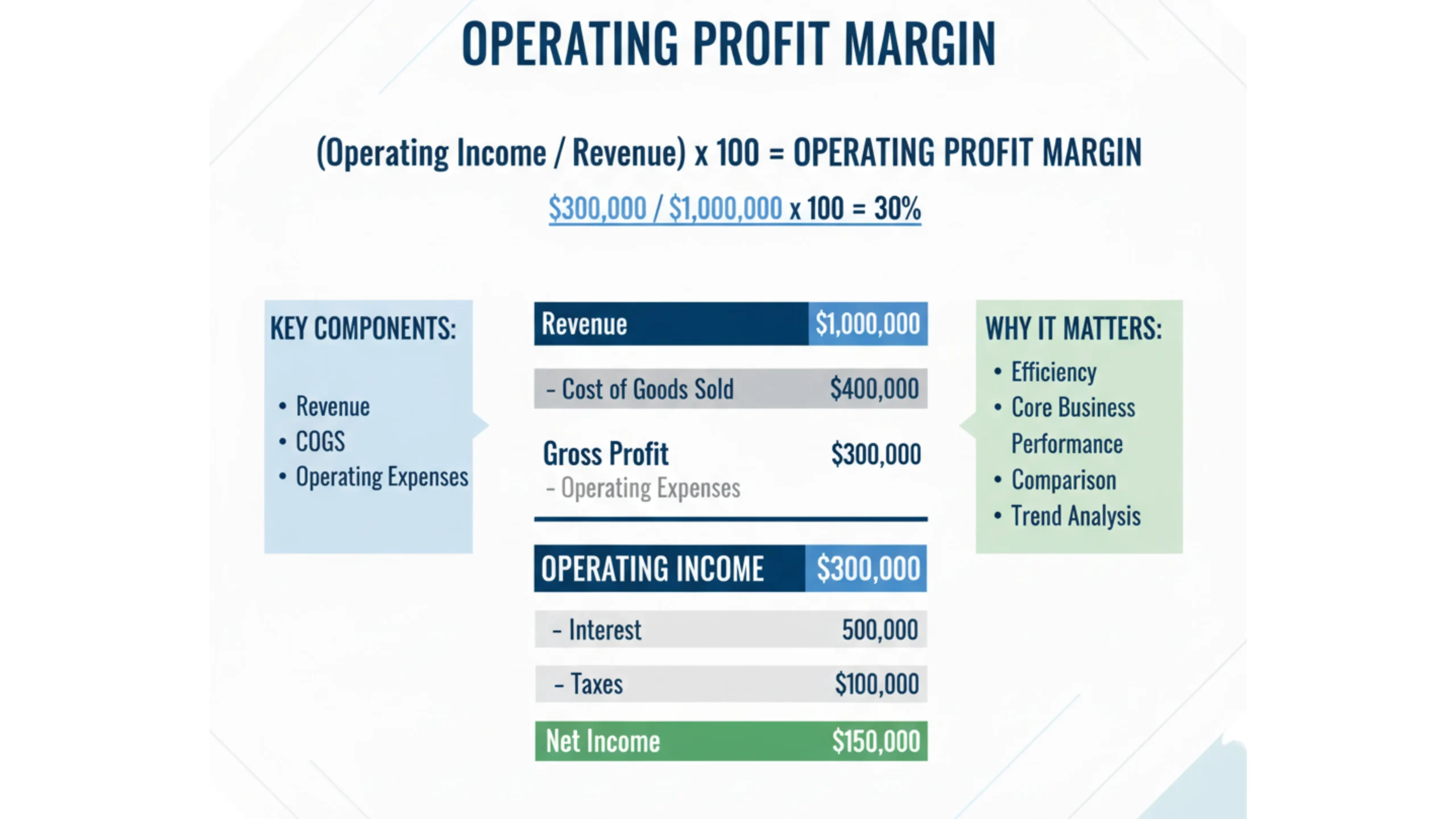

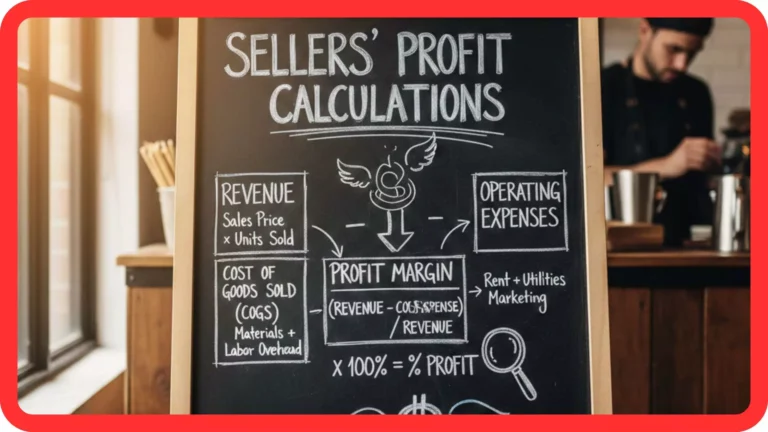

Operating Profit Margin Formula

Here’s the simple way to calculate it:

Operating Profit Margin = (Operating Income ÷ Revenue) × 100

Where:

- Operating Income (Operating Profit) = Revenue – Operating Expenses

- Revenue = Total income from business operations

Example:

If your company earns £500,000 in revenue and spends £350,000 on operating expenses, your operating profit is £150,000.

Now divide £150,000 by £500,000 and multiply by 100:

Operating Profit Margin = (150,000 ÷ 500,000) × 100 = 30%

That means for every £1 in sales, £0.30 is left after covering your core operating costs.

It’s one of the most straightforward financial performance ratios and one of the most important to track.

Why Operating Profit Margin Matters

Knowing how to calculate operating margin helps you evaluate your profitability metrics beyond surface-level revenue numbers.

Here’s why it matters:

- Tracks real efficiency: It isolates operating results from financing and taxes.

- Shows business sustainability: A consistent margin indicates a stable cost structure.

- Compares industry performance: You can benchmark against similar businesses using the same

- Supports strategic planning: Helps identify when it’s time profit margin percentage formula.

- to cut costs or increase prices.

Using an Operating Profit Margin Calculator

Doing manual calculations every month isn’t practical. A reliable operating profit margin calculator automates this process, helping you save time and reduce errors.

All you need to do is enter your revenue and operating expenses, and the tool instantly provides your profit margin percentage.

An online calculator also helps you:

- Track results over time

- Compare your margin against industry averages

- Identify trends in your operating efficiency

For anyone serious about business profitability metrics, using an operating profit margin calculator regularly is a smart move.

FAQs

What is a Good Operating Profit Margin?

A healthy operating margin percentage varies by industry, but generally 10–20% is solid. Companies with digital or tech-driven models can reach 30% or more due to lower operating expenses.

Is operating Profit Margin the same as Gross Profit Margin?

Not quite. The gross profit margin only includes direct costs like production or materials, while the operating profit margin factors in all operating expenses giving a clearer view of true financial performance.

How can I Improve my Operating Profit Margin?

Cut unnecessary costs, negotiate supplier rates, improve pricing, or automate manual work. Regularly using an operating profit margin calculator helps monitor and improve your profit ratio analysis.

How to Find Operating Profit Margin

Divide operating profit by total revenue and multiply by 100.

What is Operating Margin vs Profit Margin

Operating margin focuses on core business profitability before interest and taxes; profit margin includes all expenses and net income.

What does Operating Profit Margin tell you

It shows how efficiently a company runs its core operations.

How to Interpret Operating Profit Margin ratio

Higher ratio means better operational efficiency; lower ratio signals high costs or low revenue.

Why Operating Profit Margin Increase

It rises when revenue grows faster than operating costs or when costs are reduced efficiently.

Final Thoughts

The operating profit margin isn’t just another formula it’s the key indicator of how efficiently your company operates.

By consistently tracking your profit margin percentage and using a reliable operating profit margin calculator, you’ll gain the insights needed to make confident, data-backed business decisions.

Better numbers. Smarter moves. Stronger profits.