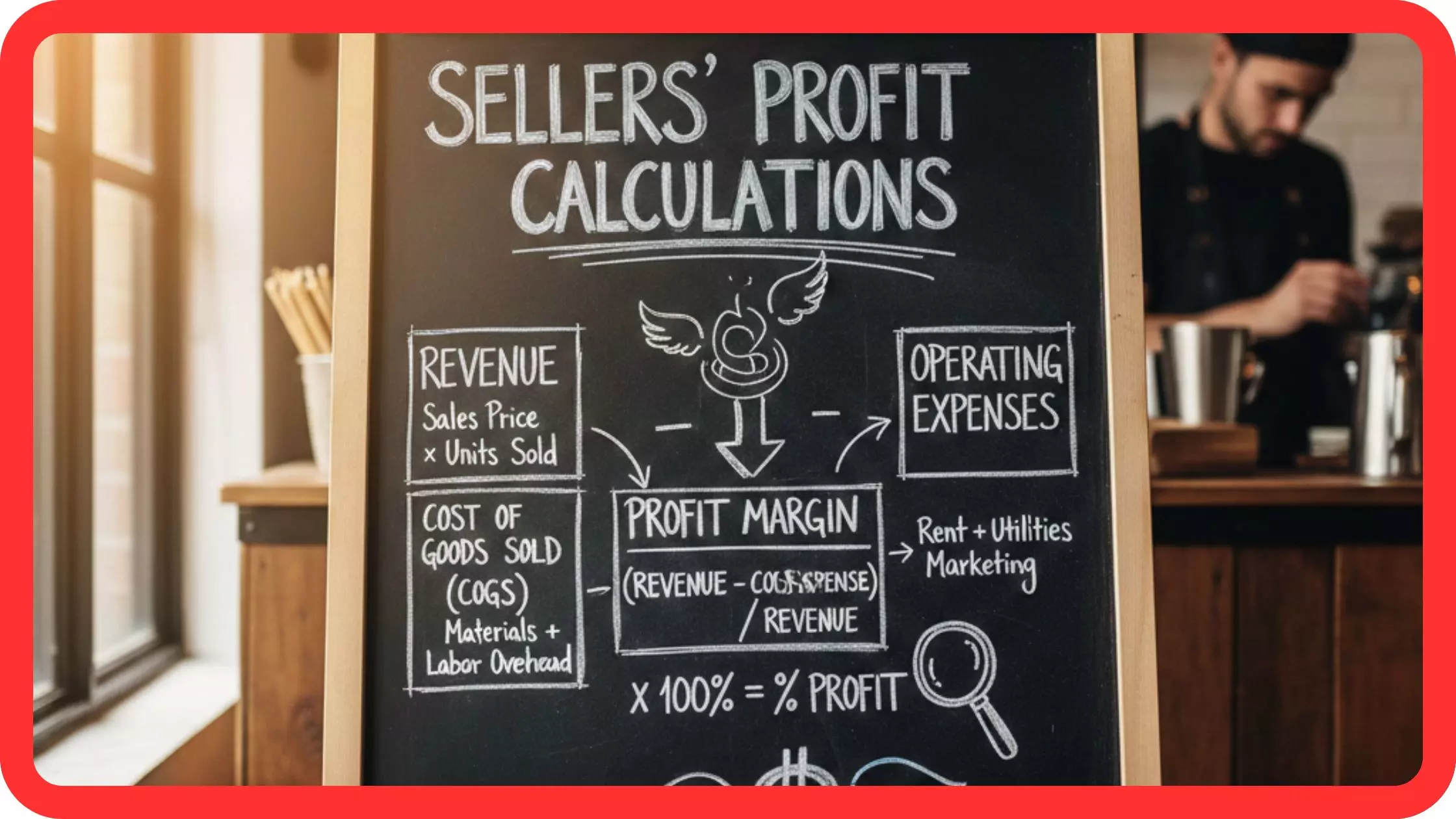

Many sellers miscalculate profit margins by ignoring hidden costs, confusing markup with margin, failing to include platform fees, taxes, returns, and advertising expenses. These errors lead to inaccurate pricing, cash-flow problems, and poor decision-making. Accurate profit margin calculations require a full cost breakdown, real-time data, and consistent financial tracking.

Introduction: Why Profit Margin Accuracy Matters

Profit margin is one of the most critical financial metrics in e-commerce, retail, wholesale, and online selling. Yet, it is also one of the most misunderstood.

Whether you sell on Shopify, Amazon, WooCommerce, Etsy, or DTC websites, incorrect profit margin calculations can:

- Inflate perceived profitability

- Cause underpricing or overpricing

- Damage long-term business sustainability

- Lead to cash flow shortages

According to accounting best practices, profit margin is not just revenue minus product cost. It reflects the total financial health of your operation.

1. Confusing Markup with Profit Margin

The Mistake

Many sellers assume markup and profit margin are the same.

The Reality

They are fundamentally different financial formulas:

- Markup = (Selling Price − Cost) ÷ Cost

- Profit Margin = (Selling Price − Cost) ÷ Selling Price

Example

- Cost: $50

- Selling Price: $100

Markup = 100%

Profit Margin = 50%

Why It Matters

Pricing strategies based on markup instead of margin often result in overestimated profitability and pricing errors.

2. Ignoring Platform and Marketplace Fees

Commonly Overlooked Fees

- Amazon referral and FBA fees

- Shopify transaction fees

- Payment gateway fees (Stripe, PayPal)

- Listing or subscription fees

Impact on Margins

Marketplace fees can consume 10–35% of revenue, significantly reducing net profit.

Best Practice

Always deduct platform fees before calculating gross or net profit margins.

3. Excluding Advertising and Customer Acquisition Costs

The Mistake

Sellers calculate margins without factoring in:

- Google Ads

- Facebook / Meta Ads

- TikTok Ads

- Influencer commissions

- Affiliate payouts

Why This Is Dangerous

A product may appear profitable until customer acquisition cost (CAC) is included.

Entity Relevance

This is especially critical for performance marketing, PPC, and ROAS-driven campaigns.

4. Forgetting Shipping, Fulfillment, and Packaging Costs

Hidden Costs Include

- Carrier shipping fees

- Fulfillment center charges

- Packaging materials

- Pick-and-pack fees

Example

A $5 packaging cost across 1,000 orders equals $5,000 lost margin if ignored.

Tip

Use average shipping cost per order to maintain consistency.

5. Not Accounting for Returns, Refunds, and Chargebacks

Reality Check

Returns are a standard part of e-commerce operations, particularly in:

- Apparel

- Electronics

- Subscription products

Cost Factors

- Reverse logistics

- Restocking fees

- Lost inventory value

- Payment processor chargebacks

Ignoring return rates leads to inflated profit margins.

6. Excluding Taxes, VAT, and Duties

Common Oversight

Sellers calculate margins using revenue figures that include tax.

Tax Types to Include

- Sales tax

- VAT (especially EU and UK sellers)

- Import/export duties

Compliance Risk

Beyond profit distortion, incorrect tax handling creates legal and regulatory exposure.

7. Using Inconsistent or Outdated Cost Data

The Issue

Costs fluctuate due to:

- Supplier price changes

- Currency exchange rates

- Shipping fuel surcharges

Consequence

Margins calculated using outdated data lead to poor pricing and forecasting decisions.

Best Practice

Update cost inputs monthly or quarterly.

8. Ignoring Overhead and Operational Expenses

Overhead Costs Include

- Software subscriptions

- Salaries and contractor fees

- Accounting and legal services

- Office or warehouse rent

Financial Principle

While not part of gross margin, these costs directly affect net profit margin.

A product with a strong gross margin can still be unprofitable at the business level.

9. Calculating Margins Per Product, Not Per Order

Why This Happens

Sellers often analyze products individually instead of analyzing the entire transaction.

Missed Elements

- Upsells and bundles

- Discounts and coupons

- Multi-item shipping efficiencies

Recommendation

Track profit per order, not just profit per SKU.

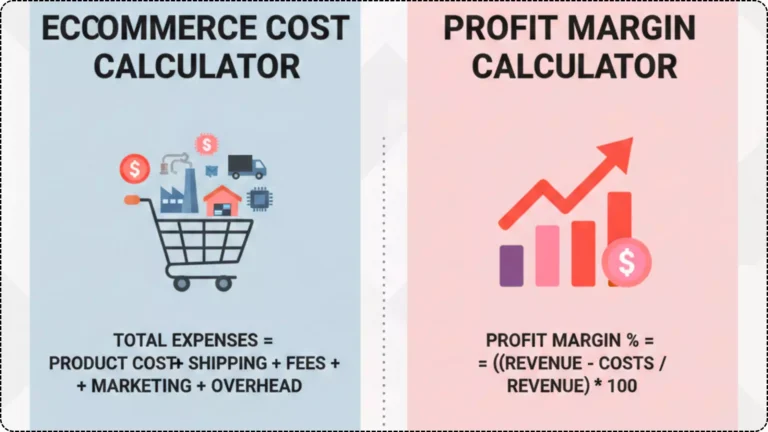

10. Relying on Manual Calculations Instead of Profit Margin Tools

Risks of Manual Spreadsheets

- Human error

- Missing cost components

- Lack of scalability

Better Alternative

Use a dedicated profit margin calculator or financial analytics tool that accounts for:

- Variable costs

- Fixed expenses

- Taxes and fees

- Advertising spend

Automation improves accuracy, speed, and decision-making.

How to Calculate Profit Margin Correctly (Best Practice Framework)

- Start with net revenue (excluding taxes)

- Deduct:

- Product cost (COGS)

- Platform fees

- Advertising costs

- Shipping and fulfillment

- Returns and refunds

- Subtract operational expenses for net margin

- Use consistent data and update regularly

Frequently Asked Questions (FAQs)

What is a good profit margin for e-commerce sellers?

Most healthy e-commerce businesses aim for:

- Gross margin: 40–70%

- Net margin: 10–20%

This varies by industry and business model.

Should advertising costs be included in profit margin?

Yes. Advertising is a direct revenue-generating expense and must be included for accurate profitability analysis.

Why do Amazon sellers often miscalculate profit margins?

Because Amazon fees (FBA, referral, storage, returns) are complex and often underestimated.

Is profit margin more important than revenue?

Yes. Revenue without profit leads to unsustainable growth and cash-flow risk.

How often should sellers review profit margins?

At minimum:

- Monthly for active sellers

- Weekly during high-spend ad campaigns

Final Thoughts

Accurate profit margin calculation is not optional—it is a core business competency.

By avoiding these common mistakes and using data-driven tools, sellers gain:

- Better pricing strategies

- Higher scalability

- Improved cash flow

- Stronger financial forecasting

Profit is not what you earn—it is what you keep after every cost is accounted for.