If you run a business whether it’s eCommerce, retail, or a service-based company profit margins are the numbers that tell you the truth about how well you’re actually doing. Revenue looks impressive on paper, but the margin is what decides if you’re thriving or just staying busy.

Understanding your profit margin, gross margin, and net margin isn’t optional. It’s how you figure out if your pricing makes sense, if your costs are under control, and if your business can sustain growth. Let’s break it down properly.

What Profit Margin Really Means for a Business

Profit margin is the percentage of revenue that remains after all your costs and expenses are subtracted. It’s basically your earning efficiency how much of every dollar you actually keep as profit.

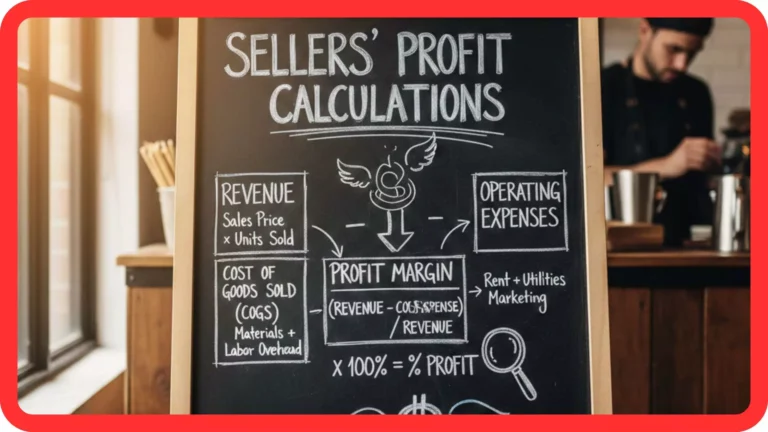

There are different types of margins you need to know:

- Gross Profit Margin: This is revenue minus the cost of goods sold (COGS). It shows how efficiently you produce or source your product.

- Net Profit Margin: This takes everything into account operating expenses, taxes, interest, and all other costs. It’s the cleanest picture of real profitability.

- Operating Margin: This shows how much profit you’re making from regular business operations before taxes and interest.

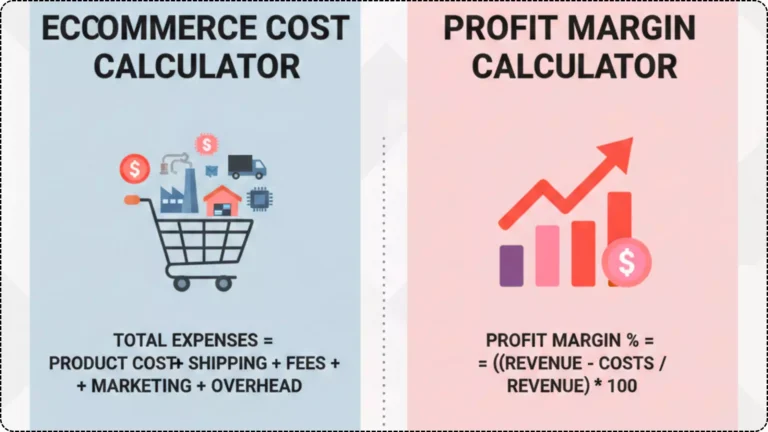

Here’s the profit margin formula most businesses use:

Profit Margin (%) = (Net Profit / Revenue) × 100

If you’re using a profit margin calculator or gross margin calculator, the process becomes simpler. Just enter your total revenue and cost of goods sold, and it’ll instantly give you your gross profit margin and net profit margin values.

These numbers guide your pricing, marketing, and cost-cutting decisions. Without understanding them, you’re basically running blind.

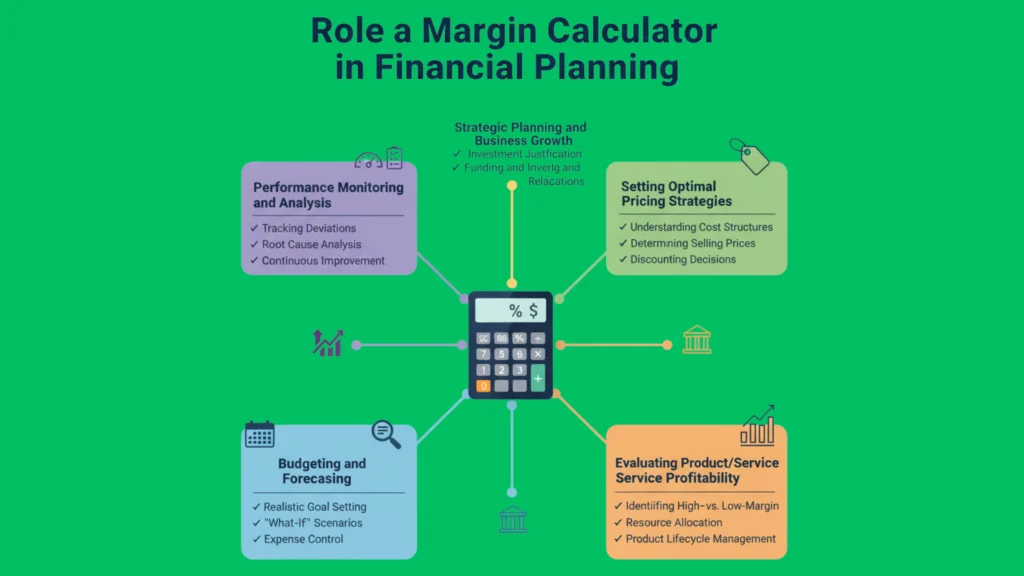

The Role of a Margin Calculator in Financial Planning

A margin calculator or business margin calculator saves time and keeps your calculations accurate. It’s not just a tool it’s your financial compass. Whether you’re figuring out your gross profit formula, your net profit margin formula, or your c margin (cost margin), a calculator helps you see where your money actually goes.

You can use different types of calculators depending on your needs:

- Gross Margin Calculator – Helps you measure how much you make before overheads and expenses.

- Net Margin Calculator – Gives you a clear look at actual profitability after every expense.

- Cost Margin Calculator – Useful for understanding how much markup to apply on your product cost.

- Product Margin Calculator or Price Margin Calculator – Helps set prices that maintain healthy margins.

Let’s say your product costs £50 to make and you sell it for £100. Your gross margin is 50%, and that’s a solid start. But when you include marketing, taxes, and shipping, your net margin might drop to 25%. A margin and profit calculator helps you catch that before you scale or launch a new product line.

This is also where markup vs. margin becomes important. Markup is how much more you charge compared to the cost, while margin is what percentage of the selling price is profit. You can calculate markup or margin using the same calculator it’s just a different angle on the same math.

Why Gross and Net Margins Matter More Than Revenue

A business can make £500,000 in sales and still lose money. That’s because revenue doesn’t account for margin cost all the hidden expenses like packaging, shipping, or ad spend that eat away at profits.

Here’s the thing: gross margin and profit margin are your performance indicators. If your gross profit margin is shrinking, your production or supplier costs are too high. If your net margin is shrinking, your overhead or operational costs are the problem.

Here are a few examples of what to monitor regularly using a gross profit margin calculator or gm margin calculator:

- The gross margin formula: (Revenue – COGS) ÷ Revenue × 100

- The net margin formula: (Net Profit ÷ Revenue) × 100

- The formula for calculating gross profit margin and formula for calculating net profit margin — both tell you where your profitability stands.

When you consistently figure out your profit margin, you can adjust your pricing or reduce costs in time. Tools like a gp margin formula or gp profit calculator make these adjustments precise.

In short, understanding gross profit and margin keeps your business healthy. Without that clarity, even a small pricing mistake can turn success into a loss.

Using Margin Data to Build a Stronger Business

Once you understand your margins, you can do three powerful things:

- Price with purpose – Instead of guessing, you can use your gross product margin and business margin calculator to price products that sustain profits and attract customers.

- Control costs – Tracking your gp margin helps you identify unnecessary expenses before they damage your bottom line.

- Plan smarter – With a clear understanding of net revenue margin and earning margin, you can plan expansions, hire talent, or increase ad spend confidently.

Most companies that fail don’t collapse because of low sales — they collapse because of poor margin and profit understanding. A proper gross margin cal or gross profit and margin analysis gives you the awareness you need to avoid that trap.

Whether you’re calculating gross profit and profit margin for a small Shopify store or a large enterprise, the logic is the same: if you don’t know your margin, you don’t know your business.

FAQs

What is the Difference Between Gross Profit Margin and Net Profit Margin?

Gross profit margin focuses on revenue minus direct costs (like materials or production), while net profit margin includes everything from marketing to taxes. Gross shows efficiency; net shows true profitability.

How can a Profit Margin Calculator help my Business?

A profit margin calculator helps you quickly measure how much profit you’re making per sale. It uses formulas like gross margin formula and net profit margin formula to eliminate manual errors and guide pricing or cost-reduction decisions.

What’s a Good Profit Margin for a Business?

It depends on your industry. For eCommerce, a net profit margin of 10–20% is strong. Service businesses often aim higher. The key isn’t hitting a universal number it’s improving your own business margin consistently over time.

Final Thought:

Understanding your profit margin is not just about math it’s about control. With tools like a gross profit margin calculator, net margin calculator, or business margin calculator, you can see exactly how much you earn and where you lose money. The more accurate your numbers, the stronger your decisions and the more stable your business growth becomes.